In the given article Apnaqanoon provides the full state Understanding Local Taxes. Tax is blood of any government and when people think about taxation they tend to look at national income tax, corporate tax or custom duty. There is, however, an equally vital mechanism that is nearer to the home- local taxes. These are the taxes that are imposed by local government like municipalities or counties or city councils and they are also significant in the financing of basic community services. Local taxes have direct implications on the day to day lives of the people as they are used to maintain roads and schools, support emergency services and waste management resources.

In this paper we are going to discuss the various forms of local tax, their evaluation, and probably the most important about them, their effects on the services of the people.

What Are Local Taxes?

Local taxes refer to taxes imposed on the local administration and services by government or municipalities in the areas to generate local tax revenue. Whereas national taxes contribute to nation-wide expenditures such as defense, retirement, or massive infrastructure development, local taxes are specifically geared towards meeting the obligation of community-based services.

They are different across countries, yet the rule is similar: the fact that people living in a locality contribute financially means that they receive improved services and amenities.

Types of Local Taxes

A combination of taxes in USA and fees are used to finance services by local governments. They are all types of some of the most common types:

Property Taxes

In perhaps the best known local tax, property tax is imposed on landowners according to the value of their property. It is computed as a ratio of the property value or assessed value in the market.

Example: An urban dweller may pay property tax of 100 at once, which would be spent on a local school, parks and libraries.

Why It Matters: Property tax is a fixed income to the municipalities since property value is normally predictable compared with other income streams.

Local Sales Taxes

In other areas, the local governments impose a sales tax on the national sales tax (or Value Added Tax (VAT). This is revenue to local budgets.

Examples In the United States, local sales tax is added to purchase in cities such as New York, the revenues of which finance transit systems and public safety.

Why It Matters Sales taxes are flexible, and closely related to consumer spending, and yet unevenly distributed in impact on lower-income households.

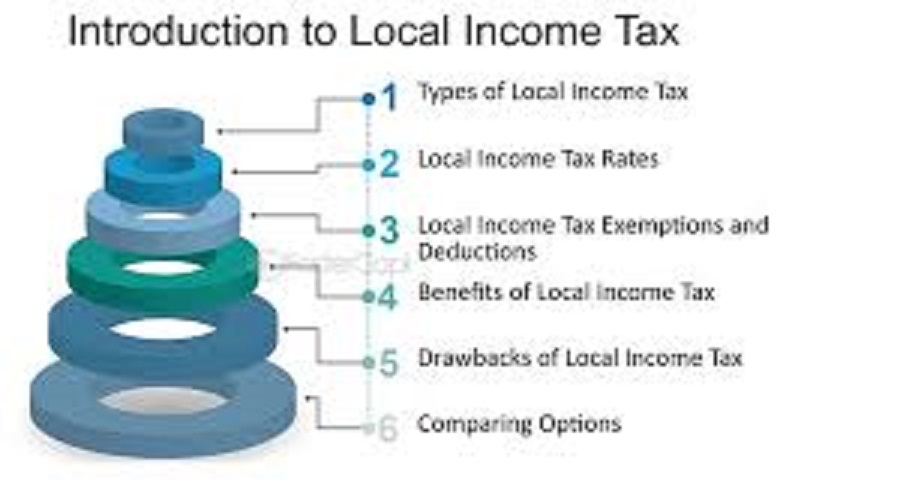

Local Income Taxes

Some localities levy their local income tax, in addition to national income tax, on people living in those localities. Prices tend to be small and considerable.

Sample: A local wage tax is imposed by some cities in the US such as Philadelphia on residents and non-residents who labor within the city boundaries.

Why It Is Important: Local income taxes enable the governments to tie tax revenue to the well-being of their labor force.

Commercial taxes and Business taxes.

The local government tend to tax business with licenses, permits and taxes on commercial property. These funds fund infrastructure, policing, and community programs that are also helpful to businesses in the area.

Example: A shop owner can be paying a license to run his business, this will help in decorating the streets, fixing the road and do local advertising.

Service Charges and Fees

Besides the traditional taxes, local governments often use service charges- parking fees or garbage collection charges or building permits.

Why It Matters: This has fees attached to a service, which guarantees effectiveness and fairness.

Local Taxes and Public services.

The local taxes do not exist as some abstract financial devices, they construct the quality of everyday life. Here is their influence on the services of the population directly:

Education

Education system is one of the greatest beneficiaries of local taxes. Funding of public schools is normally financed by property taxes especially. With more funds, better schools can have more teachers, extra-curricular activities, and current learning materials.

Impact Example: In places where property taxes are high, schools tend to be able to offer smaller classes and higher rates of school graduation than the poorer districts.

Public Safety

With help of tax revenue, local governments pay police, fire departments and emergency medical services. A well-financed local tax base also guarantees quicker reacting, safer streets and more competent first responders.

Infrastructure and Roads

Local taxes are needed to prevent roads, transport, streetlights and to remove the snow. In the absence of these, communities will have difficulty with the lack of mobility, traffic jams, and insecurity.

Examples of impact A local example in the US is that local sales taxes are directly used to finance highway maintenance and urban transport.

Health and Social Services

Social care is also a common service including elder care, disability support and housing services as offered by the local councils. Such programs play a critical role in inclusion and equality in the community.

Parks and Recreation

Local taxes are used to construct neighborhoods that are vibrant and livable: community parks and playgrounds, libraries and cultural centers of all kinds. These areas encourage sporting, studying and communication.

Waste Management and Environmental Services.

Local tax revenues are spent on waste collection, recycling programs and pollution control. Households in most regions are charged a waste collection fee depending on the size used or the number of times a waste collection is being done.

Difficulties concerning Local Taxation.

Although local taxes are very much necessary, they have not been without trouble:

- Equity Issues: Property taxes may give rise to inequality whereupon the richer regions will raise higher income thus better services compared to the poor areas.

- Local economy Dependence: When a city is mostly dependent on the sales taxes, a decline in consumer expenditure can result in shortages in the budget.

- Tax Resistance: Local communities usually resist increases in taxes, even when they subsidize services that are in high demand, and this presents a challenge to local government in developing and sustaining programs.

- Administrative Complexity: The management of individual tax systems on local and national fields may result in inefficiency and misunderstanding.

Balancing Act: Accountability and Transparency.

Accountability can be listed as one of the key benefits of local taxation. Since the local governments are nearer to the population, residents are able to view how their tax money is utilised. When citizens feel that they are part of decision making, they tend to exercise more community politics.

Transparency is key. Individuals become more ready to participate when they get to know that their property taxes are utilized to construct better schools, clean streets, and enhanced civic safety. Conversely, absence of effective communication or possible misappropriation of funds may weaken the trust of the people.

The Future of Local Taxes

With the development of societies, local governments resort to some innovative methods of taxation:

Green Taxes: There are experiments in different cities with such environmental levies as a charge on congestion or carbon taxation fee to promote sustainable behaviour.

Online Economic Adaptations: As the increase in business activities online, local governments are considering how to capture the taxes of e-commerce and online services.

Participatory Budgeting: Participation is becoming more popular where local residents are given a chance to vote in the manner a part of the local tax collection is used, enhancing trust and openness.

Such innovations can transform the current way communities fund services in future decades.

Conclusion

Local taxes are over the figures on a bill- they are the workhorses of the community services that pervade every part of life. In each local community, the Amazon of local taxation is reflected in the form of schools and roads, in relation to emergency services and parks.

Even though there are some difficulties in establishing balance between fairness, efficiency, and revenue stability, effective tax systems within the locality are the key to creating prosperous, inclusive, and sustainable societies. Knowing the importance of such taxes and how they are implemented, so that citizens can be active participants in the work of their local governments-and demand that they perform.